Growing annuity formula excel

Ad Learn More about How Annuities Work from Fidelity. Ad Learn More about How Annuities Work from Fidelity.

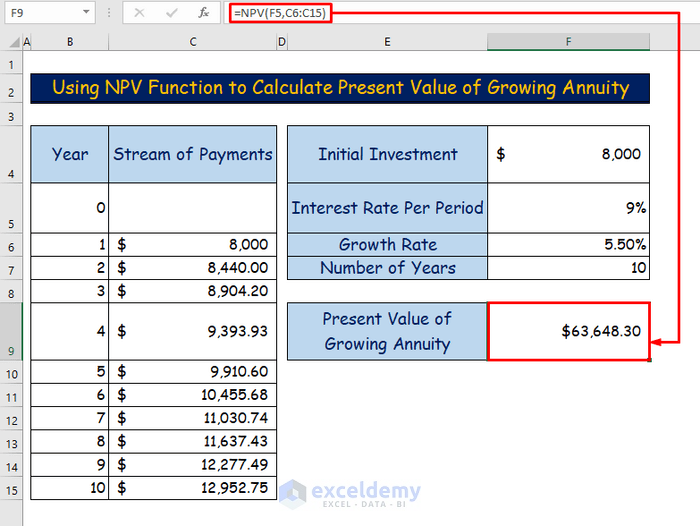

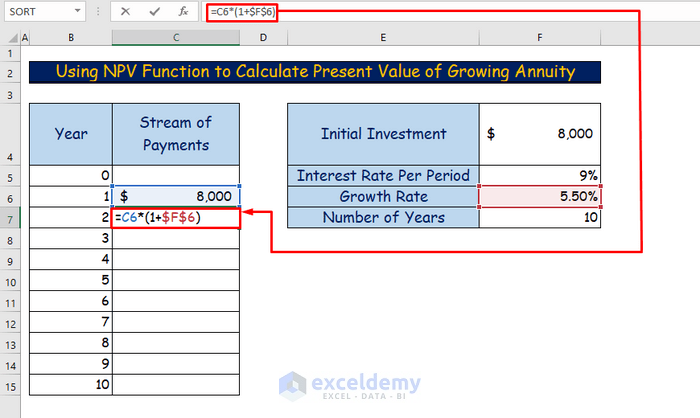

How To Calculate Growing Annuity In Excel 2 Easy Ways

Therefore the formula can be summed up.

. Therefore Stefan will be able to save 125779 in case of. You can use a formula and either a regular or financial calculator to figure out the present value of an ordinary annuity. How do you find the present value of an ordinary annuity.

The basic annuity formula in Excel for present value is PV RATENPERPMT. It is denoted as a year but it can easily be used as a time interval. Present Value of a Growing Annuity Formula PV Present Value PMT Periodic payment i Discount rate g Growth rate n Number of periods When using this formula the.

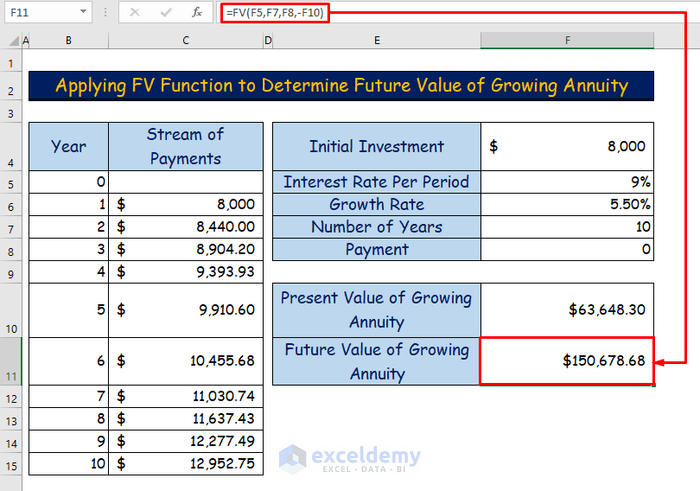

Type - 0 payment at end of. Future value of annuity Generic formula FV rate periods payment Summary To get the present value of an annuity you can use the FV function. RATE is the discount rate or interest rate NPER is the number of periods.

FVA Due 10000 1 5 10 1 1 5 5. In the example shown the formula in C7 is. Nper - the value from cell C8 25.

Calculating the present value of an annuity using Microsoft Excel is a. PV C5 C6 C400 The inputs to PV are as follows. Growing annuity formula Example.

For example assume that the initial payment is 100 and the payments are expected to grow each period at. Payment for annuity Generic formula PMT rate nper pv fv type Summary To solve for an annuity payment you can use the PMT function. The basic annuity formula in Excel for present value is PV RATENPERPMT.

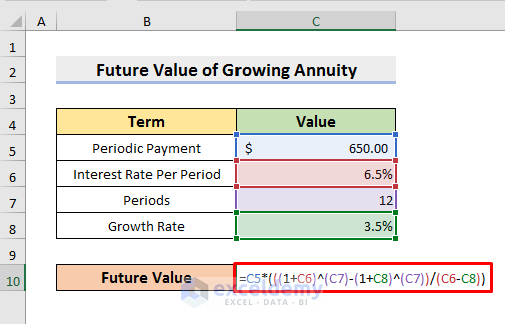

Number of Periods t. Rate - the value from cell C7 7. FVGAD 1iP 1in- 1gn i-g In the.

The future value of a growing annuity can easily be calculated by checking out. A perpetuity series which is growing in terms of periodic payment and is considered to be indefinite which is growing at a proportionate rate. N is the number of periods.

The future value of a growing annuity can be calculated in Excel by inputting all four variables into the formula 1D2 12 C2-G2 1B2 This is what pulls the. A growing annuity is an annuity where the payments grow at a particular rate. FVA Due P 1 in 1 1 i i.

About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. Lets break it down. Also the general formula for the future value of growing annuity due can be written as.

By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1. Future Value of Annuity Due 600 1 6 10 1 1 6 6 Annuity Due Formula Example 2. How do you calculate the present value of an.

FVA Due 13206787 132068. In the example shown C9 contains this. When calculating the present value of an annuity payment a specific formula is used based on the three assumptions above.

Let us look at an example of calculation of Present and Future value of an annuity. Pmt - the value from cell C6 100000. Future value FV is the value of a current asset at a future date based on an.

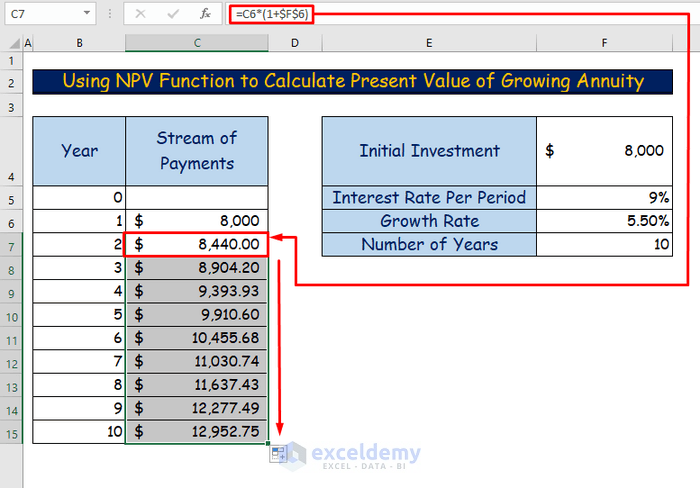

How To Calculate Growing Annuity In Excel 2 Easy Ways

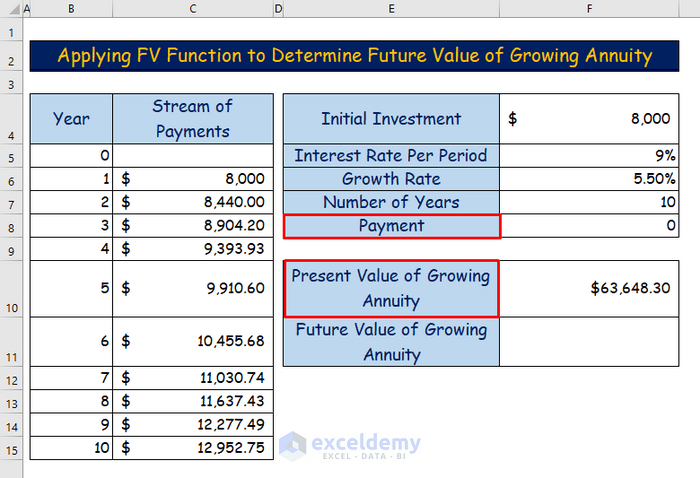

How To Calculate Future Value Of Growing Annuity In Excel

Present Value Of A Growing Annuity Formula With Calculator

How To Calculate Future Value Of Growing Annuity In Excel

How To Calculate Growing Annuity In Excel 2 Easy Ways

Excel Formula Present Value Of Annuity Exceljet

Present Value Of A Growing Annuity Calculator Double Entry Bookkeeping

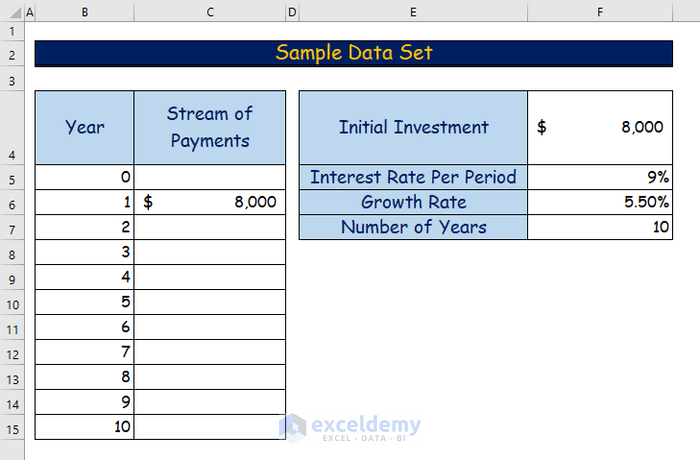

How To Calculate Growing Annuity In Excel 2 Easy Ways

Excel Formula Present Value Of Annuity Exceljet

Excel Formula Future Value Of Annuity Exceljet

How To Calculate Growing Annuity In Excel 2 Easy Ways

Graduated Annuities Using Excel Tvmcalcs Com

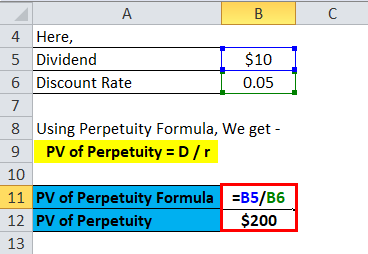

Perpetuity Formula Calculator With Excel Template

How To Calculate Growing Annuity In Excel 2 Easy Ways

Graduated Annuities Using Excel Tvmcalcs Com

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Future Value Of An Increasing Annuity Youtube